Introduction: Understanding Mutual Funds

Navigating the financial environment can be intimidating with numerous investment options. Mutual funds stand out as a popular choice for both novice and seasoned investors. Simply put, mutual funds are collective investment vehicles where investors pool capital to buy a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professionals, offering broad exposure and spreading risk with potentially higher returns at a lower capital investment.

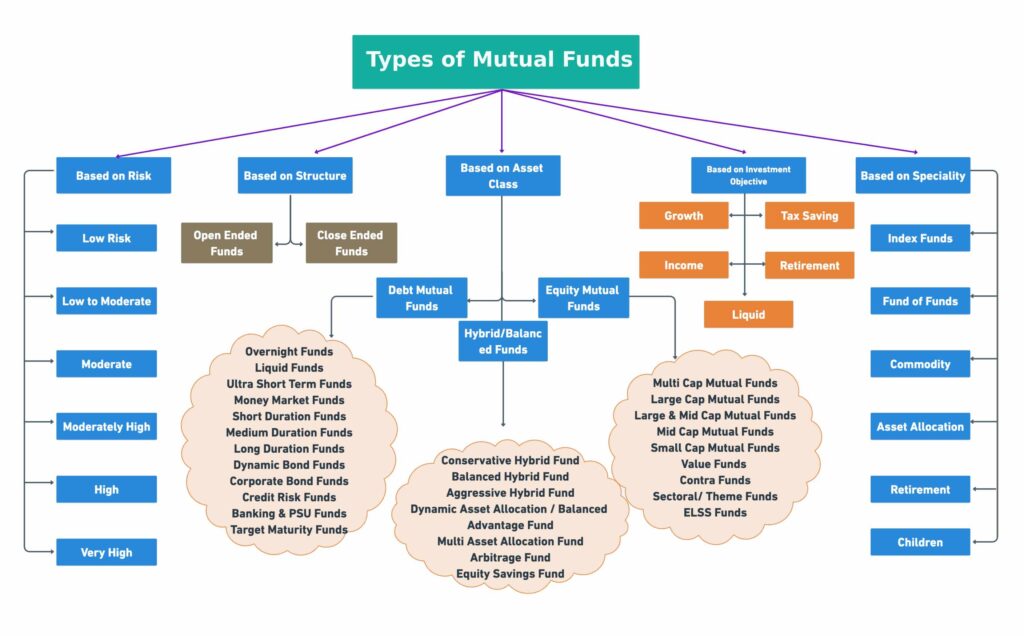

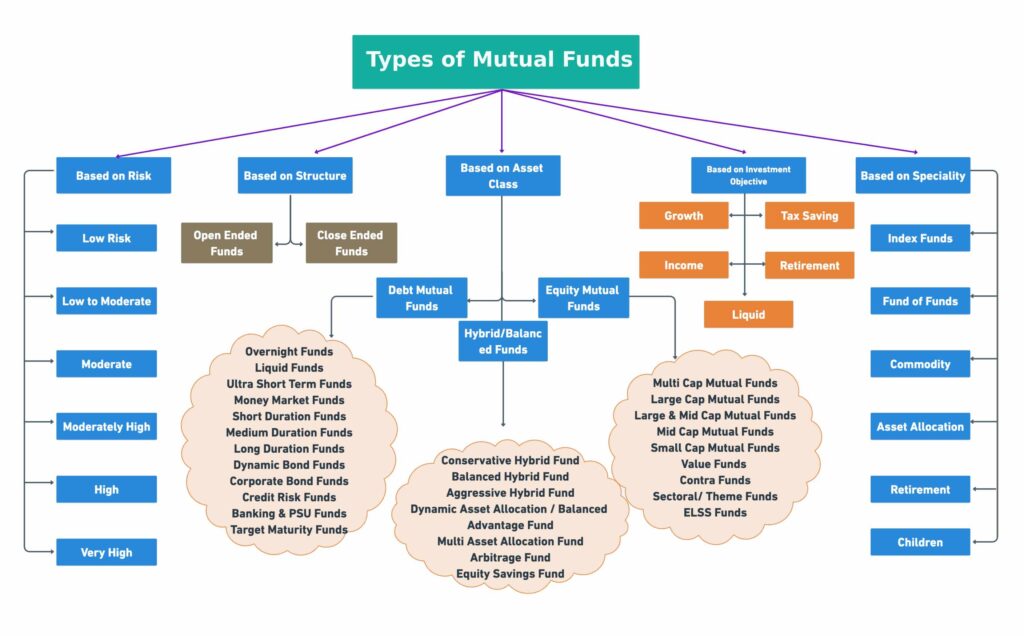

Not all mutual funds are the same; they cater to different investment goals, risk appetites, and time horizons. This guide explores various mutual fund categories based on structure, investment objectives, and asset classes. Whether your goal is wealth creation, retirement savings, or portfolio diversification, these categories will help you make informed decisions aligned with your financial objectives.

1. Mutual Funds Categorization by Structure

Open-End Funds

Open-end funds issue and redeem shares daily at their net asset value (NAV). This structure makes them highly liquid, allowing easy entry and exit for investors.

Pros of Open-End Funds:

- High liquidity: Shares can be bought or sold daily at NAV.

- Professional management: Access to diversified portfolios.

Cons of Open-End Funds:

- Potential high fees: Management charges can reduce returns.

- Market risk: Value fluctuates with market changes.

Closed-End Funds

Closed-end funds issue a fixed number of shares, which trade like stocks on an exchange. Their market price can differ from the NAV, often trading at premiums or discounts.

Pros of Closed-End Funds:

- Potential for discounts: Shares may trade below NAV.

- Flexible strategies: The fixed capital structure allows more aggressive approaches.

Cons of Closed-End Funds:

- Price fluctuations: Shares can experience significant price swings.

- Limited liquidity: Fewer shares lead to lower trading volumes.

2. Mutual Funds Categorization by Investment Objectives

Growth Funds

Growth funds invest in stocks of companies expected to grow faster than average. They focus on capital appreciation rather than income, suitable for investors with a higher risk tolerance and long-term goals.

Pros of Growth Funds:

- Potential for high returns: Targets companies with significant growth potential.

Cons of Growth Funds:

- Higher risk: Less stability and generally low or no dividends.

Income Funds

Income funds focus on generating steady income by investing in bonds, dividend-paying stocks, or other income-producing securities. They are ideal for risk-averse investors or retirees.

Pros of Income Funds:

- Regular income: Provides steady dividend or interest payouts.

- Lower risk: Generally less volatile than growth funds.

Cons of Income Funds:

- Lower capital appreciation: Limited growth potential.

- Interest rate risk: Bond prices can be affected by rate changes.

Balanced Funds

Balanced funds invest in both equities and fixed income securities to balance income, capital appreciation, and risk. They are suitable for investors seeking diversified portfolios under one management.

Pros of Balanced Funds:

- Diversification: Exposure to both stocks and bonds.

- Moderate risks: A balance between growth and income.

Cons of Balanced Funds:

- Limited upside: Lower potential gains compared to pure equity funds.

Index Funds

Index funds aim to replicate the performance of a specific index, like the S&P 500, by holding the securities in that index. They are passively managed and generally have low fees.

Pros of Index Funds:

- Low costs: Passive management reduces fees.

- Broad market coverage: Diversification across an entire market.

Cons of Index Funds:

- Limited flexibility: Cannot quickly adapt to market changes.

- Market risks: Performance tied directly to the overall market.

3. Mutual Fund Categorization by Asset Class

Equity Funds

Equity funds primarily invest in stocks, aiming for capital appreciation. They can be categorized further by investment style, market capitalization, or sector focus.

Pros of Equity Funds:

- High growth potential: Suitable for long-term investors.

- Diverse options: Various styles and sectors to choose from.

Cons of Equity Funds:

- Higher risk: More volatile and subject to market fluctuations.

- Dividend variability: Income can fluctuate significantly.

Debt Funds

Debt funds, or bond funds, invest in fixed-income securities like government and corporate bonds. They focus on providing regular income with lower risk compared to equity funds.

Pros of Debt Funds:

- Steady income: Regular interest payments.

- Reduced risk: Generally less volatile than equity funds.

Cons of Debt Funds:

- Interest rate sensitivity: Bond prices can fall when rates rise.

- Lower returns: Less potential for growth compared to equity funds.

Money Market Funds

Money market funds invest in short-term, high-grade debt instruments like Treasury bills. They offer a safe investment option with high liquidity, ideal for risk-averse investors.

Pros of Money Market Funds:

- High liquidity: Easy entry and exit.

- Low risk: Investments in high-grade, short-term instruments.

Cons of Money Market Funds:

- Low returns: Limited potential for capital appreciation.

- Inflation risk: Returns may not keep pace with inflation.

4. Specialized Mutual Funds

Sectoral/Thematic Funds

These funds focus on specific economic sectors or investment themes, offering higher growth potential but increased risk due to concentrated exposure.

Pros of Sectoral/Thematic Funds:

- Targeted exposure: Capitalize on specific economic trends.

- High growth potential: Can outperform broader market funds.

Cons of Sectoral/Thematic Funds:

- High risk: Increased volatility without diversification.

- Sector-specific downturns: Poor performance in one sector can significantly impact returns.

Ethical/Socially Responsible Funds

These funds invest in companies that meet certain ethical, environmental, or social criteria. They appeal to investors who want their investments to reflect their values.

Pros of Ethical/Socially Responsible Funds:

- Alignment with values: Invest in companies that match your ethics.

- Growing popularity: Increased demand for responsible investing.

Cons of Ethical/Socially Responsible Funds:

- Limited choices: Excluding certain sectors can limit options.

- Potential lower returns: Ethical criteria may restrict high-return opportunities.

International/Global Funds

International or global funds invest in foreign markets, offering geographic diversification and exposure to emerging and developed markets.

Pros of International/Global Funds:

- Geographic diversification: Reduce risk by investing globally.

- Exposure to growth markets: Access to international economic growth.

Cons of International/Global Funds:

- Currency risk: Exchange rate fluctuations can impact returns.

- Political and economic risk: Susceptibility to international instability.

Fund of Funds

A fund of funds invests in other mutual funds rather than directly in securities, providing diversification across various asset classes and managers.

Pros of Fund of Funds:

- Diversification: Access multiple funds and strategies.

- Professional management: Benefit from the expertise of various fund managers.

Cons of Fund of Funds:

- Higher fees: Layered costs from both the fund and underlying funds.

- Complex management: Potential for overlapping investments.

Conclusion: Selecting an Appropriate Mutual Fund

Choosing the right mutual fund involves assessing your financial goals, risk tolerance, and investment horizon. Whether your focus is on growth, income, or a mix, there’s a fund suited to your needs. Evaluate fees, management styles, and track records carefully. Mutual funds offer diversification and potential growth, but come with risks. For personalized advice, consult a financial professional to ensure your investments align with your financial objectives.